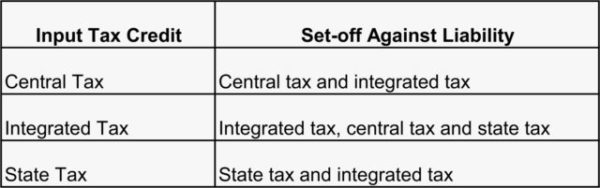

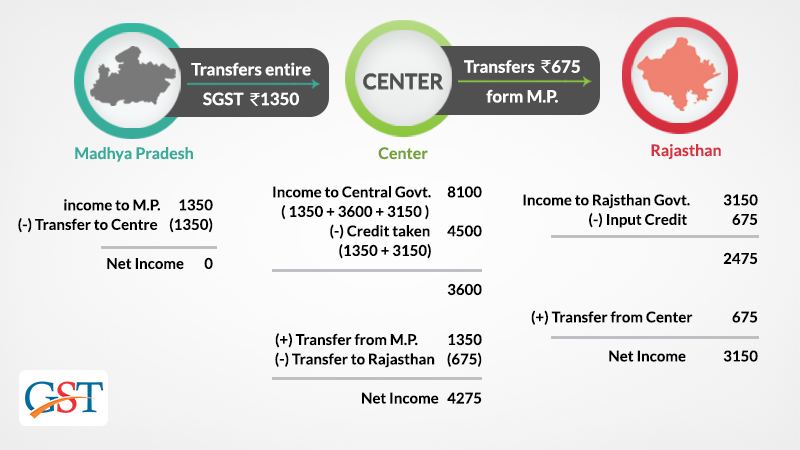

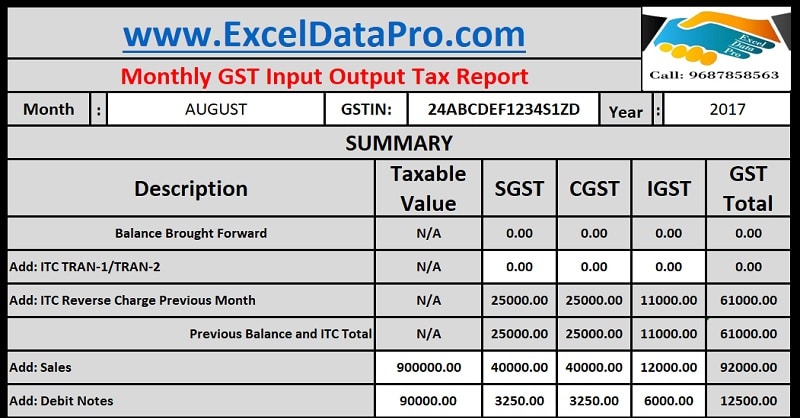

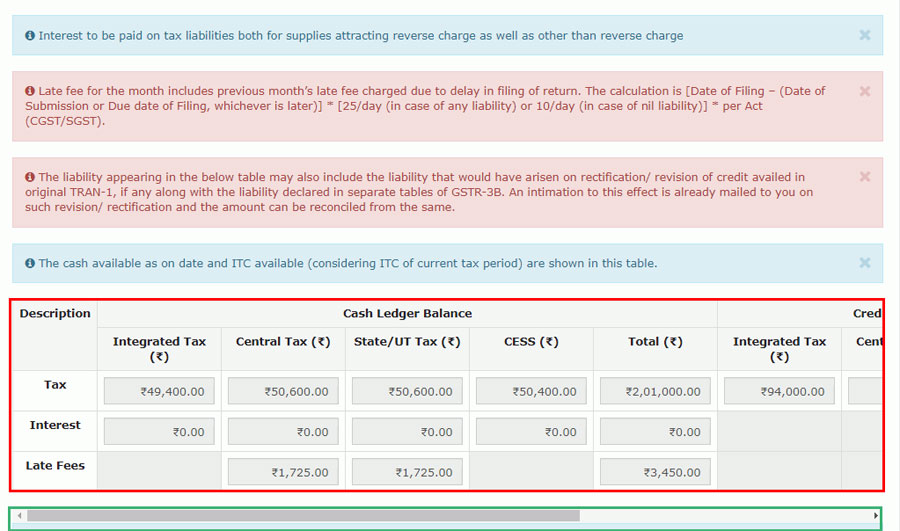

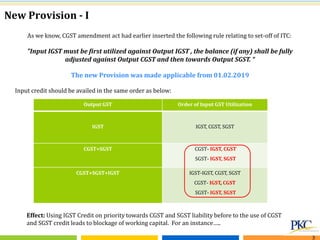

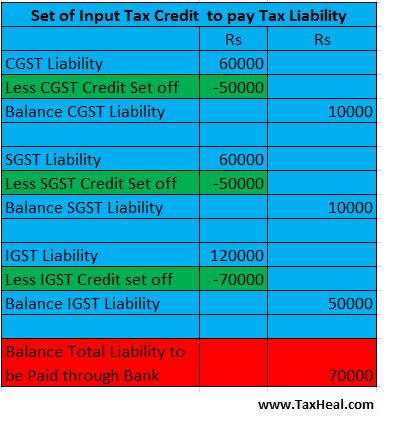

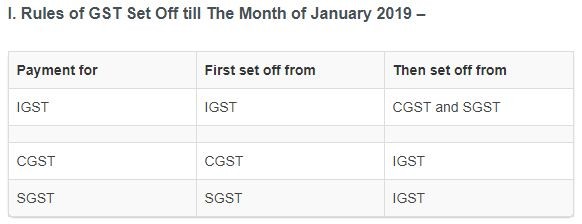

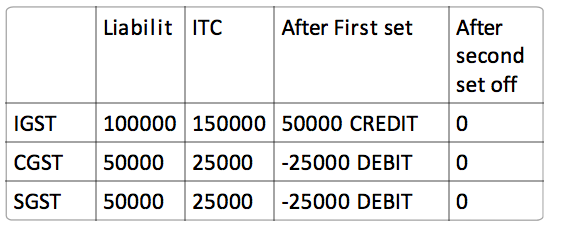

BabaTax - Input Tax Credit (ITC) for payment of GST output Tax liability, e.g IGST can be Set off against IGST and then CGST and SGST, CGST cane be set off against

Offsetting GST credits: New mechanism can lead to accumulation of CGST credits | The Financial Express